The Hidden Housing Cost of Climate Change

The League of United Latin American Citizens, a partner of ecoAmerica, is a national leader in climate action. This article was originally published in LULAC News in June 2024. It has been republished here with permission.

The Hidden Housing Cost of Climate Change

By Ava Vazquez, University of California, Berkeley, and Joaquin Macias, University of Notre Dame, LULAC Policy and Legislation Fellows

For many Latinos, homeownership symbolizes the hard work and sacrifice that embody the American Dream, offering stability and opportunities for future generations. However, the current housing market presents increasing challenges for Latinos in both maintaining and purchasing homes. One critical, yet often overlooked factor, is climate change.

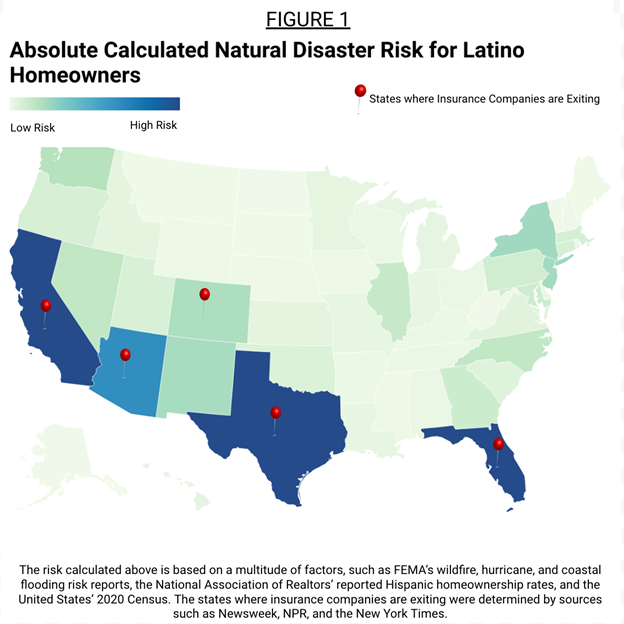

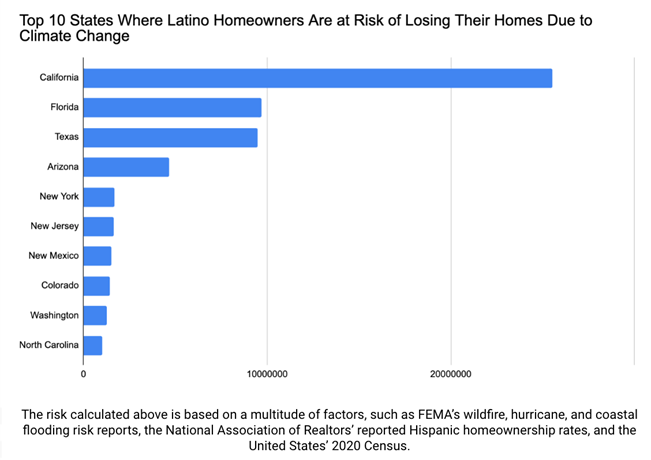

Natural disasters such as wildfires, hurricanes, and floods have driven insurance premiums to unprecedented levels. In states like California, Florida, Texas, Arizona, and Colorado, insurance companies are exiting high-risk areas because of the prohibitive costs associated with disaster-related damages. For instance, Florida saw at least six insurers go insolvent last year due to the heightened risk exposure in this hurricane-prone region. This exodus leaves homeowners in these vulnerable areas scrambling to find affordable coverage — or any coverage at all.

For those with mortgages, the loss of insurance often translates to foreclosure, as lenders typically require homeowners to maintain coverage. As climate change continues to escalate, the risk of losing homes due to unaffordable insurance rates becomes even more acute, complicating the dream of homeownership for current and future generations alike.

Historically, Latinos have been disadvantaged in homeownership. The Latino homeownership rate in the U.S. is 51.1%, compared to the national average of 65.2%, and 72.3% for white Americans. Latinos often reside along the coast and U.S. borders, the areas most vulnerable to climate events. FEMA’s National Risk Index highlights that Latino homeowners in California, Florida, Texas, Arizona, and New York are at the highest risk. The homeownership rates in these states are 46%, 55%, 59%, 59%, and 29%, respectively. From 2015 to 2023, the average cost of home insurance increased over 50% in Florida, over 40% in Texas, and more than 20% in both California and Arizona. These rising premiums mean many Latino homeowners are underinsured, forcing them to cover repair costs out of pocket, or risk losing their homes altogether.

Potential Latino homeowners face significant hurdles due to costly or unavailable insurance plans, and Latino renters may also be affected as landlords struggle with insurance costs. This financial strain could send shockwaves throughout the Latino community, already historically disadvantaged, and impact the broader U.S. economy. While New York’s insurance premium increases have been below the national average, the state’s high Latino population could face future challenges as natural disasters become more frequent. Economists often overlook the complexity of this issue, focusing on loans and mortgage rates. Yet, without insurance, mortgages are unattainable, disproportionately affecting Latinos and threatening the American Dream for millions, potentially limiting homeownership to those few who can pay in cash.

Recognizing the urgent need for action, LULAC has been at the forefront of addressing climate change impacts on Latino communities. Through a strategic partnership with ecoAmerica, LULAC’s youth Climate Change Ambassadors are on the front lines, raising awareness and mobilizing efforts to combat these daunting challenges. These ambassadors are essential in educating the Latino community about the risks of climate change and advocating for policy changes to protect homeowners. Their vital work ensures that the American Dream remains attainable, safeguarding both current and future generations from the escalating impact of natural disasters.

As climate change continues to drive up insurance costs and force companies out of high-risk areas, Latino homeowners face a growing threat to their stability and future prospects. Addressing these challenges requires immediate and comprehensive solutions to ensure that the American Dream remains attainable for all, safeguarding both current and future generations from the escalating impact of natural disasters.

Visualizations by Carisma De Anda, University of California, Berkeley, Cesar Espino, Texas Wesleyan University, and Alexa DeLeon, College of Saint Benedict & Saint John’s University — all distinguished LULAC Policy and Legislation Fellows.

About the Authors

Ava Vazquez (University of California, Berkeley) and Joaquin Macias (University of Notre Dame) are Policy and Legislation Fellows at the League of United Latin American Citizens.

Additional Resources

Watch the American Climate Leadership Awards 2024

Watch the 2024 American Climate Leadership Awards for High School Students

Mental Health and Our Changing Climate: Children and Youth Report 2023